Cost to Import Towels from China: Complete Breakdown for 2025

When it comes to importing towels from China, understanding the complete cost structure is critical for profitable international trade. From sourcing and shipping to tariffs and customs duties, every element plays a vital role in determining your final landed cost. In this detailed guide, we break down all the expenses involved in importing towels from China so you can make informed and profitable business decisions.

Why Import Towels from China?

China remains the world’s largest exporter of textiles, including cotton and microfiber towels. The country’s competitive manufacturing costs, advanced production technologies, and well-developed logistics network make it an ideal choice for global importers. Whether you are sourcing bath towels, kitchen towels, hotel-grade linens, or microfiber sports towels, Chinese suppliers offer:

- Low production costs

- High-quality materials

- Flexible Minimum Order Quantities (MOQs)

- Custom branding and private labeling options

- Efficient export infrastructure

China’s towel manufacturing hubs—primarily in Hebei, Jiangsu, and Shandong provinces—are known for their robust textile industries and advanced weaving and dyeing processes.

1. Understanding the Cost Components

Before calculating your total import expenses, you need to understand each cost category. Here’s a breakdown of the main cost factors:

| Cost Component | Description | Typical Range (USD) |

|---|---|---|

| Product Cost (Ex-Factory) | Base price from supplier | $0.50 – $3.50 per towel or more than USD10 for top quality special towels. |

| Freight & Shipping | Ocean or air transport | $1,000 – $6,000 per container |

| Customs Duties & Taxes | Import tariff and VAT | 8% – 20% of product value |

| Customs Clearance Fees | Local logistics & documentation | $100 – $300 per shipment |

| Port Handling Charges | Loading, unloading, warehousing | $50 – $150 |

| Domestic Transportation | Delivery from port to warehouse | $100 – $500 |

Each of these costs varies based on your shipment volume, transportation method, and destination country.

2. Product Cost (Ex-Factory Price)

The ex-factory price is the starting point for calculating your import expenses. It includes the production cost, labor, and manufacturer’s profit margin, but not shipping or insurance. Several factors influence towel pricing in China:

- Material type: Cotton towels generally cost more than polyester or microfiber variants.

- GSM (Grams per Square Meter): Higher GSM indicates thicker, heavier towels.

- Design and dyeing complexity: Customized prints or embroidery add to the price.

- Order quantity: Larger orders reduce the per-unit cost due to economies of scale.

Example pricing (2025 averages): only for reference, final price upon order quantity, quality standard, package, logo and so on.

| Towel Type | Material | Average Price per Unit (USD) |

|---|---|---|

| Bath Towel | 100% Cotton | $1.80 – $3.50 |

| Hand Towel | Cotton/Poly Blend | $0.80 – $1.50 |

| Microfiber Sports Towel | Polyester Blend | $0.50 – $1.20 |

| Hotel-Grade Towel | Premium Cotton | $2.50 – $4.00 |

3. Freight and Shipping Costs

Freight is the second-largest cost component when importing from China. Importers can choose between ocean freight and air freight, depending on order size and urgency.

Ocean Freight

For bulk shipments, ocean freight offers the most cost-effective solution. Shipping a 20-foot container costs between $1,000 and $3,000, while a 40-foot container may range from $3,000 to $6,000, depending on the season and route. Ocean freight is ideal for high-volume orders (10,000+ units), non-urgent deliveries (30–45 days transit), and achieving lower per-unit shipping costs.

Air Freight

If you need towels urgently, air freight is faster but significantly more expensive—typically $4–$8 per kilogram. This method suits small businesses importing samples or limited quantities. Tip: To reduce freight costs, collaborate with freight forwarders who consolidate shipments and offer competitive rates.

4. Customs Duties and Import Taxes

Import duties vary based on the destination country’s HS (Harmonized System) code classification for towels. For example, HS Code 6302.60 is for towels made of cotton, and HS Code 6302.93 is for towels made of synthetic fibers.

Approximate customs duty rates:

- United States: 9–12%

- European Union: 8–10%

- United Kingdom: 7–12%

- Australia: 5%

- Canada: 8–10%

In addition to duties, importers must also pay Value Added Tax (VAT) or Goods and Services Tax (GST) based on the CIF (Cost, Insurance, and Freight) value. For example, in the UK, VAT is 20%, while in Australia, GST is 10%.

5. Customs Clearance and Handling Fees

After your goods arrive at the port, you’ll need to clear customs. Common expenses include:

- Broker fees: $100 – $250 per shipment

- Inspection fees: If customs requires a quality or safety inspection

- Documentation charges: For bills of lading, commercial invoices, and packing lists

- Port handling fees: $50 – $150 per shipment

Efficient customs handling ensures your towels are released quickly and without penalties.

6. Domestic Transportation and Warehousing

Once your goods clear customs, they must be transported to your warehouse or retail facility. Domestic transportation costs depend on distance and logistics providers.

- Short-distance truck delivery: $100 – $300

- Long-distance delivery: $300 – $600

- Warehousing fees: $0.50 – $1.50 per cubic foot per month

Partnering with third-party logistics providers (3PLs) can streamline your operations, offering warehousing, labeling, and distribution services.

7. Hidden and Miscellaneous Costs

Importers often overlook hidden expenses that impact profitability, such as:

- Currency exchange fluctuations

- Insurance costs (1–3% of shipment value)

- Inspection or third-party quality control fees

- Product testing for compliance (e.g., OEKO-TEX certification)

- Packaging and labeling costs

Always include a 10–15% contingency margin in your budget to cover unexpected expenses.

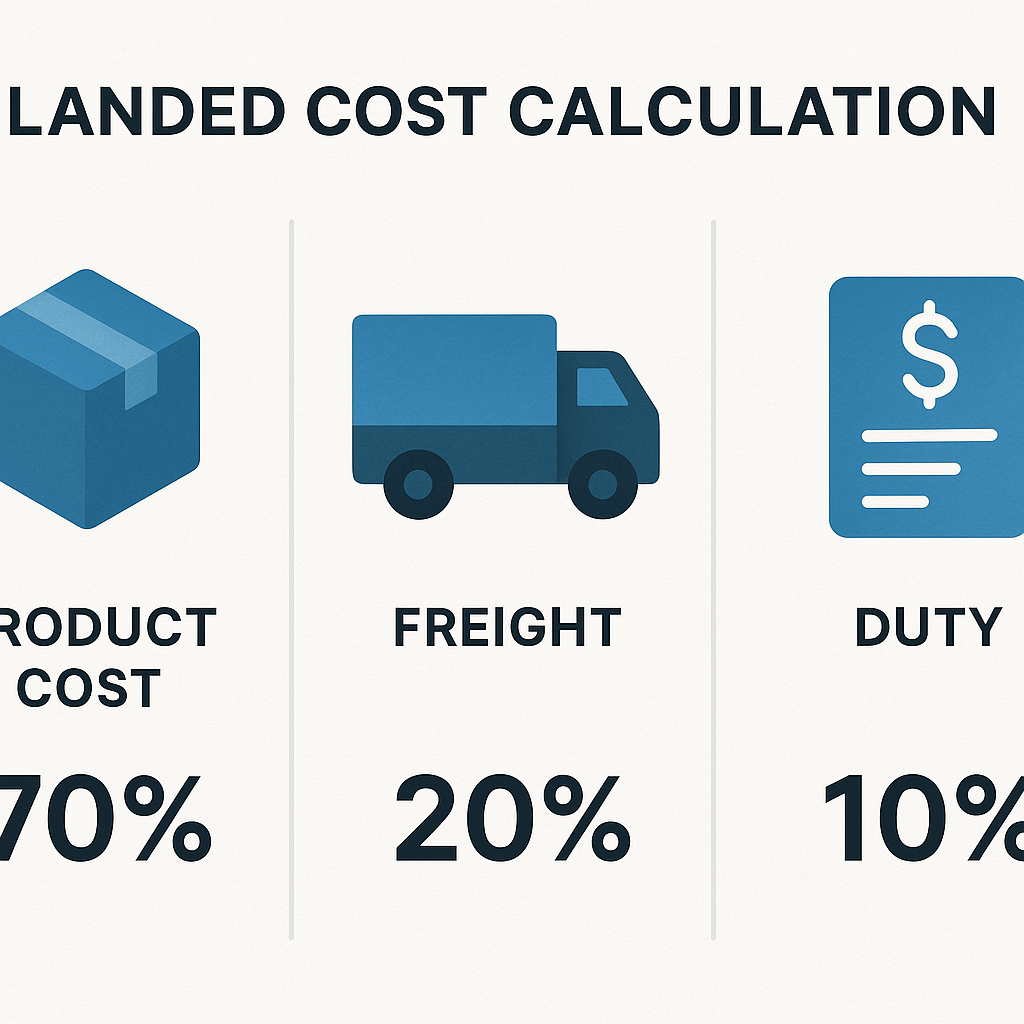

8. Example: Total Landed Cost Calculation

Let’s calculate the total landed cost for importing 10,000 cotton bath towels from China to the United States.

| Cost Category | Amount (USD) |

|---|---|

| Product Cost ($2.00/unit) for example | $20,000 |

| Ocean Freight | $2,500 |

| Insurance | $300 |

| Customs Duty (10%) | $2,000 |

| Port & Clearance Fees | $250 |

| Domestic Transport | $300 |

| Total Landed Cost | $25,350 |

| Landed Cost per Towel | $2.54 |

This example shows that freight and customs costs add around 25% to the product’s factory price. And maybe have more additional Trump Tarrif and duty some times for USA market.

9. Tips to Reduce Import Costs

To maximize profit margins, consider these practical cost-saving strategies:

- Order in bulk: Higher quantities reduce per-unit costs.

- Negotiate with suppliers: Build long-term relationships to secure better terms.

- Use FOB (Free On Board) terms: Let the supplier handle local logistics up to the port.

- Compare freight quotes: Use multiple forwarders to find the best deal.

- Consolidate shipments: Combine smaller orders to save on shipping.

- Monitor exchange rates: Pay when your local currency is strong.

- Choose cost-efficient ports: Sometimes alternate ports reduce tariffs or fees.

10. Finding Reliable Towel Suppliers in China

Conton fair or other trade show, Google Search, AI Search, Government , Agencey, or other B2B plat forms. Before placing an order, always:

- Request product samples.

- Verify supplier certifications (ISO, OEKO-TEX).

- Read past buyer reviews.

- Conduct a factory audit if ordering in bulk.

This minimizes the risk of receiving poor-quality or non-compliant products.

11. Final Thoughts

Importing towels from China can be highly profitable when you understand and control each cost component. From choosing the right supplier to optimizing shipping and customs processes, every step affects your total landed cost. By planning strategically and negotiating effectively, you can ensure high-quality products at competitive prices—a winning combination for your business.